29+ how to calculate cac payback

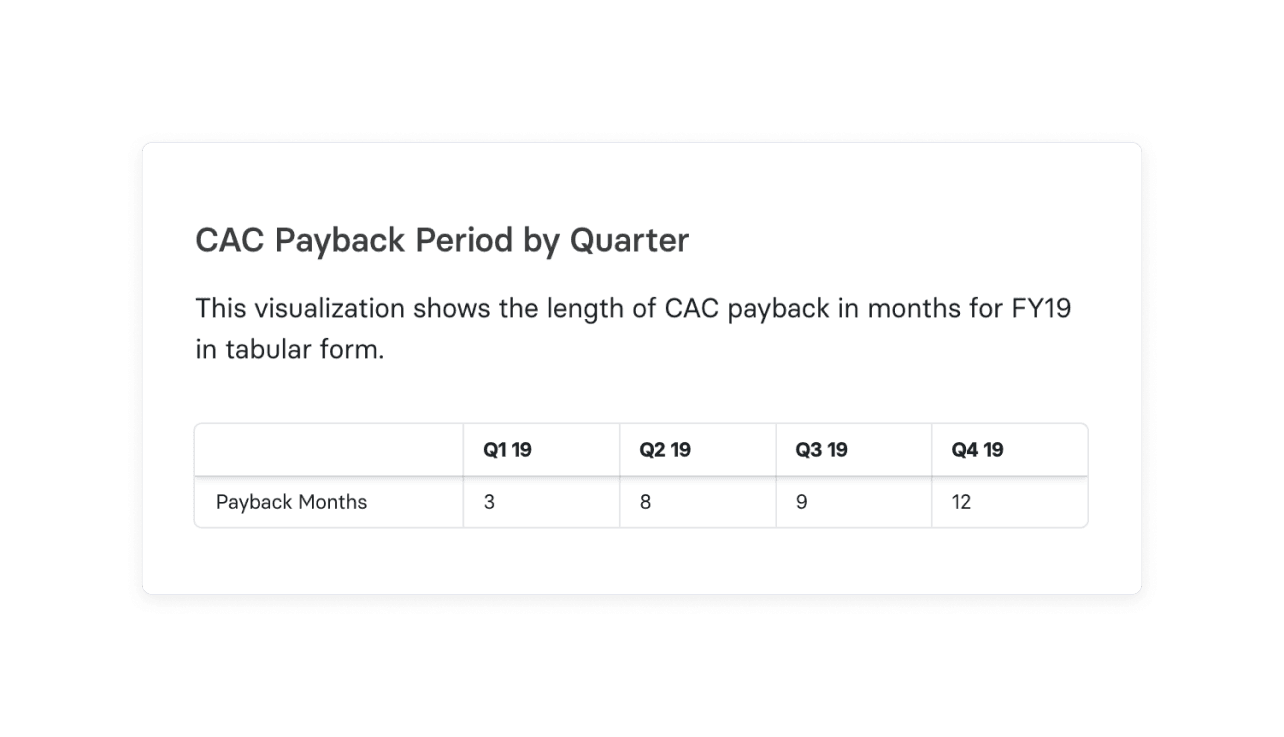

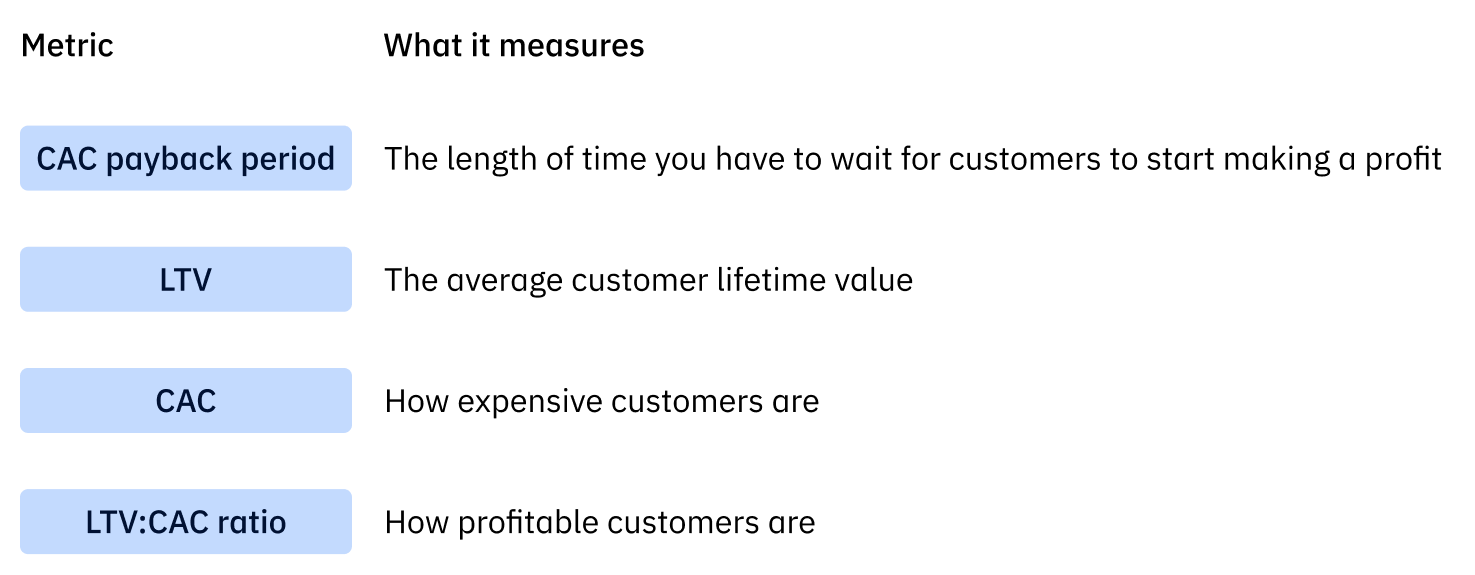

Web The calculation for CAC Payback period 12M sales and marketing expenses offset by three months 275 Net New MRR X 75 Gross Margin 58. Web The payback period in capital budgeting is the amount of time it takes for your company to recover the cost of acquiring one customer.

Cac Payback Period Metrichq

Web Once you determine CAC you can then calculate the CAC payback period.

. Web The payback period is calculated by dividing the amount of the investment by the annual cash flow. Web In this short video I explain the CAC Payback Period a key SaaS metric. In order to calculate CAC Payback Period you need to know.

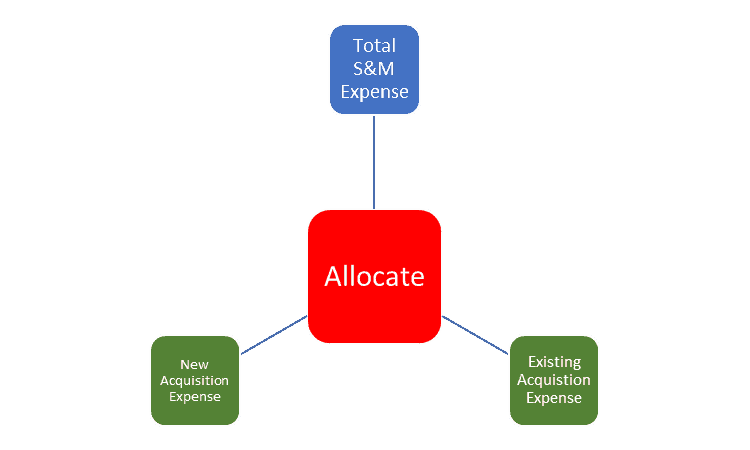

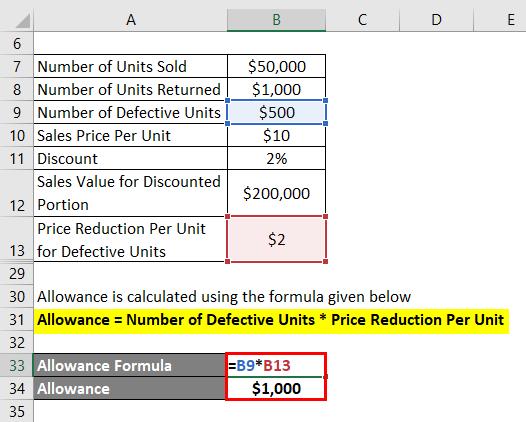

Web Customer acquisition cost is the best approximation of the total cost of acquiring a new customer. Web Then the companys CAC is calculated as. Web Calculate the fully loaded CAC including sales and marketing expenses then determine lifetime value LTV while taking into consideration gross margin.

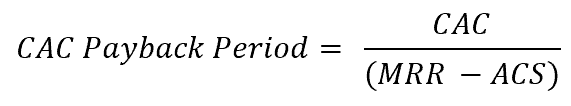

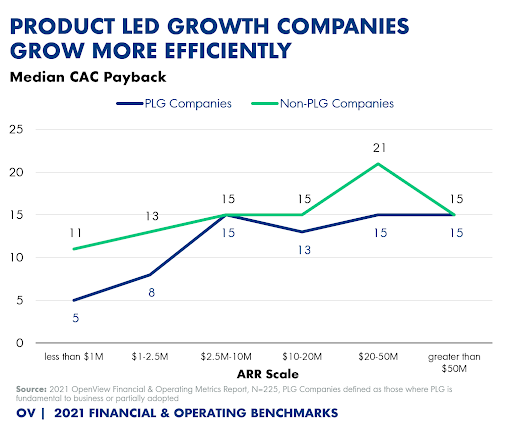

Take your CAC and divide them by your Monthly Recurring Revenue MRR minus your Average Cost of Service. Web How to calculate CAC Payback Period. Web Calculating CAC Payback Period With Gross Margin.

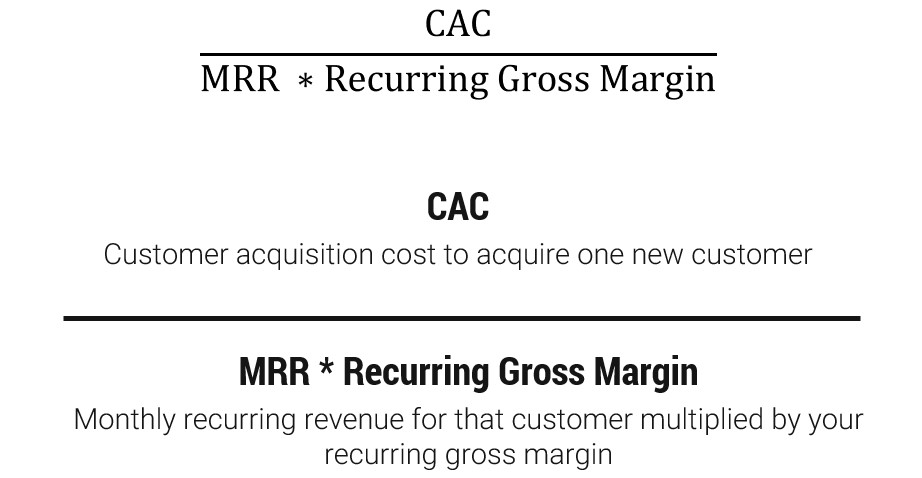

The CAC payback period formula combines the numbers from steps one through three to determine how many subscription periods youll. For example a customer that costs 350 to. CAC ARPAX Gross Margin Months to Recover CAC.

A Manufacturing Company If a manufacturing. Web The CAC payback period calculation would look like this. Web Calculating the CAC payback period is as simple as taking the customer acquisition cost CAC and dividing it by the monthly recurring revenue MRR.

Learn how to calculate and to understand the key nuances. Account and fund managers use the payback period to. It should generally include things like.

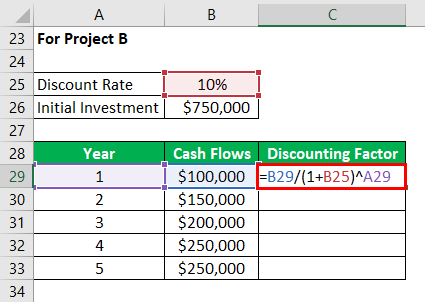

Inputs for logo-based CAC Payback Period The spreadsheet snippet below visualizes. Determine Your CAC Payback Period. CAC ARPAx Gross MarginPercentage CAC Payback Keep in mind that you can also calculate CAC.

Web To measure the CAC payback period you need to divide the sales and marketing expenses by the monthly recurring revenue MRR acquired and the gross. Web To calculate the logo-based CAC payback period we need the inputs below. CAC 5000 1000 1000 6000 1000 6 Example 3.

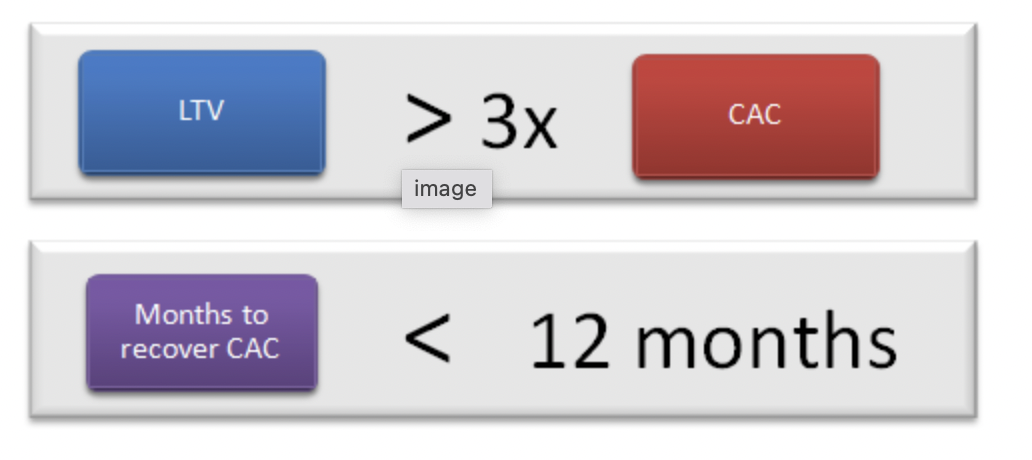

Adding a gross margin to the equation increases the payback time but provides a more realistic number. Divide the CAC by the difference of your net new monthly recurring revenue MRR any customer. Web This is the simplest way to calculate your CAC Payback Period.

Then to get your final. 20000 5000 x 075 533 months This shows us that after the 5 months and change are over every dollar over the. Web Here is the CAC payback periodformula.

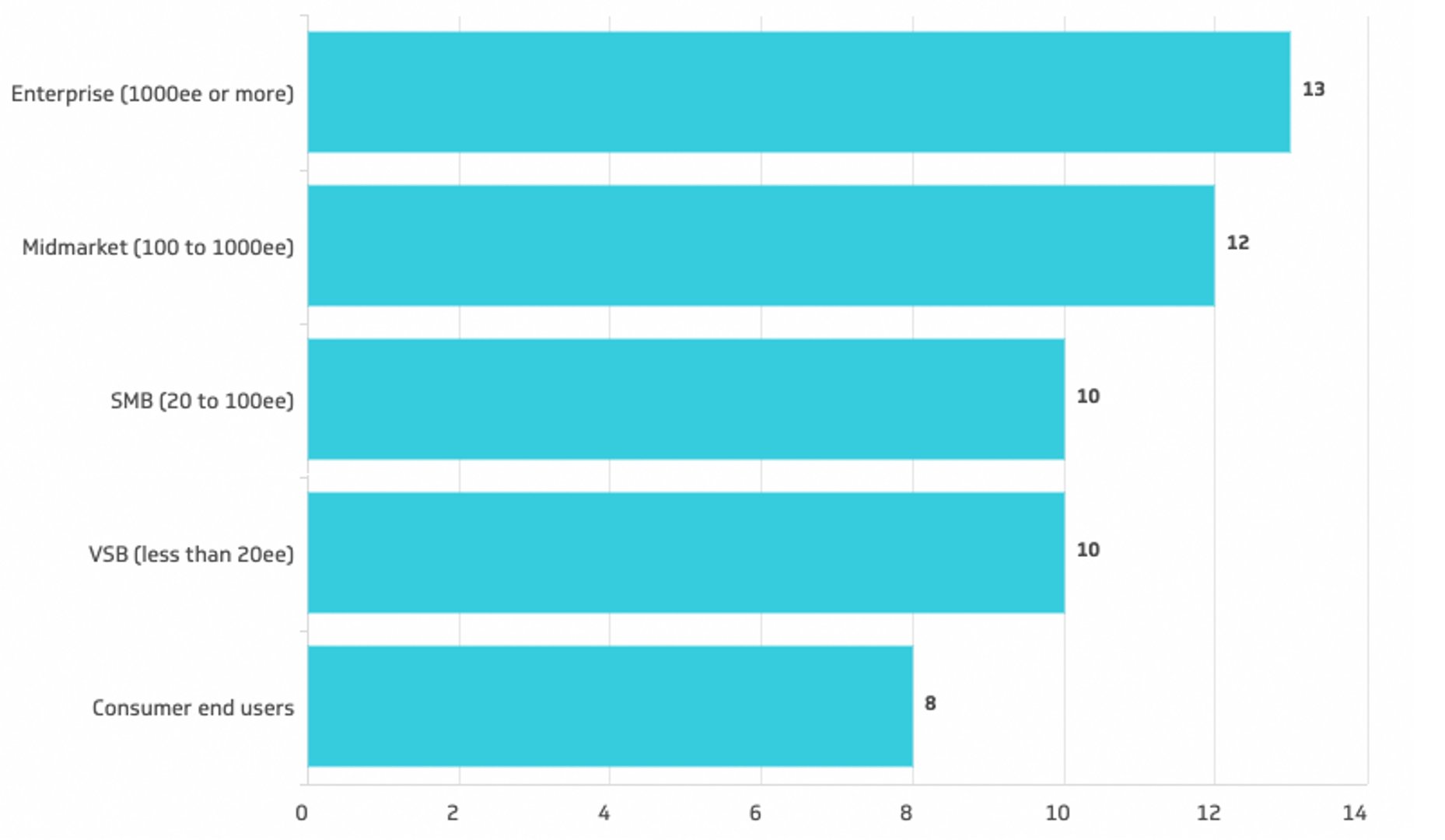

The value depends on how high the Customer Acquisition. Web CAC Payback Period is the time it takes for a company to earn back their customer acquisition costs.

Cac Payback Period Explained Formula Tips Mosaic

How To Reduce Your Cac Payback Period And Accelerate Growth

How To Calculate Your Overall Cac Payback Period The Saas Cfo

Cac Payback Period Calculator Excel Template Youtube

Cac Payback Period How To Calculate It Why It Is Important

Cac Payback Period Saas In 60 Youtube

How I Calculate The Cac Payback Period The Saas Cfo

Net Present Value Formula Examples With Excel Template

Cac Payback Period Master That Sweet Spot Tl Dv

How I Calculate The Cac Payback Period The Saas Cfo

Cac Payback Period Saasin60

How To Calculate Cac Payback Period With Variable Revenue The Saas Cfo

Cac Payback Basics What It Is How To Calculate It And Why It Matters Openview

Net Sales Formula Calculator Examples With Excel Template

How To Calculate Your Overall Cac Payback Period The Saas Cfo

A Brief Guide To Cac Payback And How To Calculate It Pry

A Brief Guide To Cac Payback And How To Calculate It Pry